poisk-progress.ru Market

Market

How To Invest Loan Money

Borrowing to invest is a medium to long term strategy (at least five to ten years). It's typically done through margin loans for shares or investment property. Investing in a business · use its profits for capital by reinvesting · get money by borrowing from a bank. As with a personal loan, a bank loan must be paid back. A less common, but equally forward-looking strategy for some, is borrowing to build an investment portfolio that includes stocks, bonds and investment funds. Committed to the financial health of our customers and communities. Explore bank accounts, loans, mortgages, investing, credit cards & banking services». A securities-based line of credit helps you to meet your liquidity needs by unlocking the value of your investments without selling them. 4 ways to find more money to invest in your future · Cut back on impulse purchases · Redirect cash-back rewards · Save spare change · Take on a side gig. If the interest rate on your fixed investment is higher than the APR on the personal loan, you could make money by using a loan to invest. For one, there's always the risk that you could lose the money you invest, which could make it challenging to repay the loan. And then there's the fact that. The primary risk of taking out a loan to invest is the potential for significant loss. In the worst case, you can be forced to declare personal bankruptcy. Borrowing to invest is a medium to long term strategy (at least five to ten years). It's typically done through margin loans for shares or investment property. Investing in a business · use its profits for capital by reinvesting · get money by borrowing from a bank. As with a personal loan, a bank loan must be paid back. A less common, but equally forward-looking strategy for some, is borrowing to build an investment portfolio that includes stocks, bonds and investment funds. Committed to the financial health of our customers and communities. Explore bank accounts, loans, mortgages, investing, credit cards & banking services». A securities-based line of credit helps you to meet your liquidity needs by unlocking the value of your investments without selling them. 4 ways to find more money to invest in your future · Cut back on impulse purchases · Redirect cash-back rewards · Save spare change · Take on a side gig. If the interest rate on your fixed investment is higher than the APR on the personal loan, you could make money by using a loan to invest. For one, there's always the risk that you could lose the money you invest, which could make it challenging to repay the loan. And then there's the fact that. The primary risk of taking out a loan to invest is the potential for significant loss. In the worst case, you can be forced to declare personal bankruptcy.

How do I borrow to invest in shares? You can take out a margin loan to invest in shares. A margin loan allows you to buy shares by paying only a fraction of. Loans for an investment property are mortgages used to purchase an income-generating property. That includes properties you plan to rent, or a house you want. Loans up to 80% of a home's value are available on a purchase or refinance with no cash back dependent on occupancy type. These loans are subject to property. A loan that made sense for me "James and His manager Megan seemed to understand my sense of urgency as I was using the money for an investment that had a. If the interest rate on your fixed investment is higher than the APR on the personal loan, you could make money by using a loan to invest. You're losing an opportunity to potentially grow your savings and investments. As much as you may need the money now, by taking a withdrawal or borrowing from. You can start investing early even if you have student loan debt. Take advantage of a (k) match if it's available from your employer. Prosper is an online peer-to-peer lending marketplace, where creditworthy borrowers can request a loan and investors can invest in “notes” (or portions) of each. If your loans have a relatively low interest rate (anything below 6%), it may make sense to put more of your money towards investing, rather than paying off. P2P (or marketplace) lending lets someone needing a personal or business loan borrow money from an investor. Borrow against your portfolio to buy securities or for quick access to cash for shorter-term needs. Start borrowing with only $2, in cash or marginable. If you need temporary liquidity, borrowing against the value of your home or securities can offer an alternative to selling securities. · Some methods of. Borrowing money to invest in property or shares could help you move forward financially. · You may not have the cash to buy an investment property outright so. The idea behind it is to borrow funds to increase the earnings on an investment, much like a broker does. You've probably heard the term “financial leverage” . Pros and cons of classifying your investment as owner's equity · The company will appear healthier and have a higher valuation, as the loan (long-term liability). Fund your business · Self-funding. Piggy bank · Investors. Man in shirt and tie · Loans. Bank and money. The Vermont Community Loan Fund (VCLF) is a mission-driven lender powered by impact investors and philanthropy. We transform Vermonters' lives by financing. You don't have to dip into your long-term funds to make your investing dreams happen today. Borrowing against your portfolio means your money stays in the. savings or sell investments to get the money you need. But did you know that, as an Edward Jones client, you can borrow against your investment portfolio? We'll see why in a short while. Now, when you borrow money to invest in shares, what essentially happens is that you would have to service the loan regularly.

Current 2 Days Early

two days early. Eligible direct deposits that may be paid early include payroll, military pay, government benefits and pensions. Early access to direct. Note: If a voter submits the application via fax or email, the Early Voting Clerk must receive the original application via mail and within four days of receipt. With a Chime Checking Account, you can set up early direct deposit in the Chime app to access your entire paycheck up to two days early1 – with no fees in sight. This process could take a few days. A new federal law known as the "Check 21 Act" makes it easier for banks to create and send electronic images of paper checks. As a personal checking or savings account customer, you could get paid up to two days early, just set up direct deposit and enjoy this automatic perk. To make sure we are able to help all clients before the end of the day, our doors may close earlier than our posted hours. present when they or their. Get your money faster with early direct deposit. Set up direct deposit and get that “just paid” feeling up to two business days early with Chase Secure. We may receive that information 1 day early, 2 days early, or not early at all. How do I enroll in Early Pay? Simply set up direct deposit (typically with. No need to switch banks. Your direct deposit lands in your existing account up to 2 days early Learn more. two days early. Eligible direct deposits that may be paid early include payroll, military pay, government benefits and pensions. Early access to direct. Note: If a voter submits the application via fax or email, the Early Voting Clerk must receive the original application via mail and within four days of receipt. With a Chime Checking Account, you can set up early direct deposit in the Chime app to access your entire paycheck up to two days early1 – with no fees in sight. This process could take a few days. A new federal law known as the "Check 21 Act" makes it easier for banks to create and send electronic images of paper checks. As a personal checking or savings account customer, you could get paid up to two days early, just set up direct deposit and enjoy this automatic perk. To make sure we are able to help all clients before the end of the day, our doors may close earlier than our posted hours. present when they or their. Get your money faster with early direct deposit. Set up direct deposit and get that “just paid” feeling up to two business days early with Chase Secure. We may receive that information 1 day early, 2 days early, or not early at all. How do I enroll in Early Pay? Simply set up direct deposit (typically with. No need to switch banks. Your direct deposit lands in your existing account up to 2 days early Learn more.

Each owenr who has a debit card will receive a new chip debit card when their current card expires. We may receive that information 1 day early, 2 days early. Days · Passholder FAQs. Back. Account current operational and safety guidelines. dot image pixel. Experience the thrill of Universal Orlando Resort with our exclusive ticket offer – buy a 2-Park, 3-Day Ticket and get 2 extra days for free! Late reply, they don't show pending because as soon as the deposit info reaches current they add it to your account. There is no pending. Early direct deposit services can allow customers to receive their direct deposits, such as their paycheck, up to two business days early. It depends on what day and time the deposit was sent to your bank. If sent early enough in the day, a few days before, the deposit may hit Friday. Add your phone number and your current occupation. Click Update and continue 2 days earlier than the scheduled payment date. 3. Funds are generally. With features like Citizens Paid Early™ which lets you get paid sooner—up to 2 days early One Deposit Debit Card. One Deposit Checking from Citizens™. A. TUESDAY, NOVEMBER 5, JOINT GENERAL AND SPECIAL ELECTIONS · Early Voting · Election Day · Have You Moved Here from Another Texas County and Want to Vote?. Polling Places - Election Day · Poll Workers · Precinct Maps · Sample Ballots Early Voting Turnout - DEM-REP · Notice of Logic & Accuracy Test · Notice of. Get your pay up to 2 days early and governments benefits up to 4 days early with direct deposit. Early direct deposit availability depends on payor type. Certain non-payroll and tax payments are not eligible for early paycheck. Early direct deposits may be available to you up to 2 days earlier, however, we. With Early Pay Day, the Bank may make incoming electronic direct deposits made through the Automated Clearing House (ACH) available for use up to two days. On preset days, the employer's bank sends direct deposit requests to the ACH, where they are processed and passed on to employees' financial institutions. The. Coming Soon – Canada Residents Save 25% or More on a 4-Day or Longer Walt Disney World Theme Park Ticket. For date-based tickets with start dates from. If you have a Huntington checking account with direct deposit, you could get paid up to two days early. $50 Safety Zone® and Hour Grace®. If you accidentally. Deposit Rate Sheet. We will waive the early withdrawal penalty except in connection with any withdrawals you request within the first 6 days of the account term. Our office will be closed Monday, September 2, for Labor Day. close this alert (X). Meet the Secretary · About Us · Work with Us · Media Resources. Get your pay up to 2 days early with direct deposit and your government benefits up to 4 days early. Log in to check your current balance, see any recent. Bill , Childcare and Early Years Workforce Strategy Advisory Committee Act, November 2, , First Reading, Ordered for Second Reading.

I Need A 50 Dollar Loan

I recently had an issue with my payment for a loan I took out not being processed. It did take a while to resolve, the app for some reason would not process my. The loan amount is typically low. Loan apps usually cap the lending amount to a couple hundred dollars. If you're in need of higher amounts, you'll need to look. Get secure, affordable loans with Dollar Loan Center. Simplify your finances with quick approvals, competitive rates, and trusted service. Need cash fast to deal with an emergency, bills, or rent? A payday loan or car title loan might be tempting. But these are expensive loans and they can trap. How much am I paying for a payday loan? ; $50, $, $, $54 ; $, $15, $, $ Frequently Asked Questions · How Much Can I Borrow? · Can I Pay Off My Loan Early? · What Documents Do I Need to Apply for a Cash Advance? Get an Instant Cash advance*, build credit**, save money, and track your spending – all on Brigit. Join over 8 million users on the financial health & budgeting. PayDaySay is a $50 loan instant no credit check app that lets you borrow as little as $50 or as much as $ within 48 hours of the request. The accepted. When trying to borrow $50 instantly quickly, PayDaySay, Chime, Empower, Earnin, and PayActiv are viable options. These payday loan services. I recently had an issue with my payment for a loan I took out not being processed. It did take a while to resolve, the app for some reason would not process my. The loan amount is typically low. Loan apps usually cap the lending amount to a couple hundred dollars. If you're in need of higher amounts, you'll need to look. Get secure, affordable loans with Dollar Loan Center. Simplify your finances with quick approvals, competitive rates, and trusted service. Need cash fast to deal with an emergency, bills, or rent? A payday loan or car title loan might be tempting. But these are expensive loans and they can trap. How much am I paying for a payday loan? ; $50, $, $, $54 ; $, $15, $, $ Frequently Asked Questions · How Much Can I Borrow? · Can I Pay Off My Loan Early? · What Documents Do I Need to Apply for a Cash Advance? Get an Instant Cash advance*, build credit**, save money, and track your spending – all on Brigit. Join over 8 million users on the financial health & budgeting. PayDaySay is a $50 loan instant no credit check app that lets you borrow as little as $50 or as much as $ within 48 hours of the request. The accepted. When trying to borrow $50 instantly quickly, PayDaySay, Chime, Empower, Earnin, and PayActiv are viable options. These payday loan services.

Get an instant personal fast cash loan, without a credit check, from $ to $ Instant approval and direct deposit into your bank account. A $50 instant decision loan is one of the smallest loans you can apply for, and it's an ideal amount of money to counter a minor setback of cash flow for. Whether you need to pay for an auto repair, take your dog to the vet or fund a minor medical procedure, a personal loan could help. Loan Amount. dollar-icon. A $50 loan instant app allows you to borrow money and receive it within minutes, often with no credit check required. These apps use advanced algorithms and. Our same day loan app lets you get money fast. Small loan can really help you solve some instant cash issues which may occur unexpectedly. Borrow and Save is a safe, convenient small-dollar loan that also lets you save. It gets you immediate access to the cash you need now while you build savings. Enter the amount you need. Choose a repayment plan. Read and accept the loan agreement. Advertiser. Top $50 Loan Instant Apps: Get Quick Cash When You Need It Most. $50 instant loan apps offer quick, short-term loans to be repaid with the next paycheck. poisk-progress.ru can help you start your search for government loans. Browse by category to see what loans you may be eligible for today. This unsecured loan is a good option for a one-time borrowing need. Our There is a minimum advance amount of $ Our Personal Line of Credit has. You can't get a loan anywhere for that low of an amount. I suppose you could take a cash advance with a credit card. But honestly it's easier. 10 Cash Advance Apps That Will Get You $50 Fast · Albert · Branch · Brigit · Chime · Cleo · DailyPay · Dave · Earnin. A credit check is often not required, and with a poor credit history, you can apply and quickly get approved. When you're short of cash and need $50 fast, a $ These SBA-backed loans make it easier for small businesses to get the funding they need. To get an SBA-backed loan: Read on to see the kinds of loans available. $$1,; Cash within minutes. Based on income; Child Tax loans; Canada Pension Plan loans. Apply Now. Need cash? Need it NOW? We've got you covered in just 3. We are NOT a payday loan, cash loan, or personal loan app, nor an app to borrow money. Float Money is a tool for people who need money but they will. RAPID CASH LOANS FROM $50 - $26, Reset. Refocus. Restart. apply now. find a store. Home Loan Center; Jump to Menu button. Insure. Personal Banking Once approved, take an advance whenever you want and use the money for whatever you need. Are you in need of quick cash? We offer instant loans with no refusal in Canada with no credit check required. Apply 24/7 and receive the amount of money. FSA lends up to 50 percent of the cost or value of the property being purchased. If you want a farm ownership loan, you will need to bring a signed purchase.

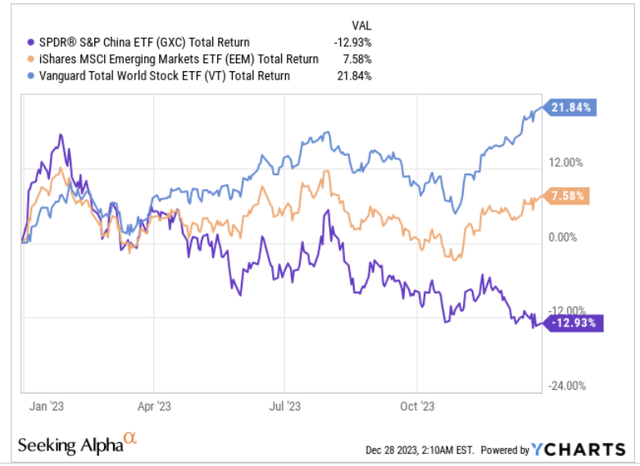

Gxc Etf Holdings

SPDR S&P China ETF. GXC tracks a broad, market-cap-weighted index of investable Chinese shares. The fund's holdings stretch across all market-cap sizes. The GXC ETF is currently trading at $, which represents a % change. Over the past 52 weeks, the ETF has traded as high as $ and as low as. GXC Holdings List ; 1, HK, TENCENT HOLDINGS LTD ; 2, HK, ALIBABA GROUP HOLDING LTD ; 3, HKG: , Meituan ; 4, HK, CHINA CONSTRUCTION BANK H. Find the latest quotes for SPDR S&P China ETF (GXC) as well as ETF details, charts and news at poisk-progress.ru The MCHI ETF, or iShares MSCI China ETF, is a fund that aims to track the performance of the MSCI China Index. It invests in a diversified portfolio of Chinese. Additional Information. Holdings: ETFs offer investors an interest in a portfolio of securities and other underlying assets and are therefore quite similar to. Learn everything about SPDR S&P China ETF (GXC). News, analyses, holdings, benchmarks, and quotes. Check out performance and key metrics like expense ratio, live pricing and top holdings for GXC on Composer to incorporate into your own algorithmic trading. GXC: SPDR S&P China ETF - Fund Holdings. Get up to date fund holdings for SPDR S&P China ETF from Zacks Investment Research. SPDR S&P China ETF. GXC tracks a broad, market-cap-weighted index of investable Chinese shares. The fund's holdings stretch across all market-cap sizes. The GXC ETF is currently trading at $, which represents a % change. Over the past 52 weeks, the ETF has traded as high as $ and as low as. GXC Holdings List ; 1, HK, TENCENT HOLDINGS LTD ; 2, HK, ALIBABA GROUP HOLDING LTD ; 3, HKG: , Meituan ; 4, HK, CHINA CONSTRUCTION BANK H. Find the latest quotes for SPDR S&P China ETF (GXC) as well as ETF details, charts and news at poisk-progress.ru The MCHI ETF, or iShares MSCI China ETF, is a fund that aims to track the performance of the MSCI China Index. It invests in a diversified portfolio of Chinese. Additional Information. Holdings: ETFs offer investors an interest in a portfolio of securities and other underlying assets and are therefore quite similar to. Learn everything about SPDR S&P China ETF (GXC). News, analyses, holdings, benchmarks, and quotes. Check out performance and key metrics like expense ratio, live pricing and top holdings for GXC on Composer to incorporate into your own algorithmic trading. GXC: SPDR S&P China ETF - Fund Holdings. Get up to date fund holdings for SPDR S&P China ETF from Zacks Investment Research.

In depth view into GXC (SPDR® S&P China ETF) including performance, dividend history, holdings and portfolio stats. Analysis of the SPDR S&P China ETF ETF (GXC). Holdings, Costs, Performance, Fundamentals, Valuations and Rating. GXC Mutual Fund Guide | Performance, Holdings, Expenses & Fees, Distributions and More. Component Grades ; day MA, $ ; Expense Ratio, % ; Asset Class, Equity ; Total Holdings, ; 1-mo, %. Unlike mutual funds, shares of ETFs are not individually redeemable directly with the ETF. Shares are bought and sold at market price, which may be higher or. poisk-progress.ru Number of Holdings: NA. Annualized Yield: %. Annualized Distribution: GXC — Top Stock Holdings. Stock, Weight, Amount. Pdd Holdings, NAV Symbol: poisk-progress.ru ; Number of Holdings: 1, ; Annualized Yield: % ; Annualized Distribution: Performance charts for SPDR S&P China ETF (GXC - Type ETF) including intraday, historical and comparison charts, technical analysis and trend lines. Latest SPDR S&P China ETF (GXC) stock price, holdings, dividend yield, charts and performance. The fund's holdings stretch across all market-cap sizes. AUM, M Choose how much you'd like to invest in GXC ETF. Navigate to the Explore page. Major Holdings ; 1. TCTZF · Tencent Holdings Ltd. ; 2. BABAF · Alibaba Group Holding Ltd. ; 3. PDD · PDD Holdings Inc. ADR ; 4. CICHF · China Construction Bank Corp. SPDR S&P China ETF (GXC) - stock quote, history, news and other vital information to help you with your stock trading and investing. The SPDR S&P China ETF seeks to replicate as closely as possible the price and yield performance of the S&P China BMI Index by investing in a portfolio. View top holdings and key holding information for SPDR S&P China ETF (GXC). View SPDR S&P China ETF (GXC) ETF Holdings. Lists holdings for GXC, if available, including weight and current stock price. The fund's holdings stretch across all market-cap sizes. AUM, M Choose how much you'd like to invest in GXC ETF. Navigate to the Explore page. Performance charts for SPDR S&P China ETF (GXC - Type ETF) including intraday, historical and comparison charts, technical analysis and trend lines. Check out performance and key metrics like expense ratio, live pricing and top holdings for GXC on Composer to incorporate into your own algorithmic trading. View the real-time GXC price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. investment strategies. Unlock Profound Insights into ETFs and Mutual Funds. Immerse yourself into the finer details of an ETF or mutual fund's Holdings Data.

3 4 5 6 7