poisk-progress.ru Overview

Overview

Best Trading App For Small Amounts

E*TRADE: Invest. Trade. Save. 4+. Stocks, options, mutual funds. E*TRADE Securities. Designed for iPad. Save, invest and learn from one easy app. INVEST Icon. INVEST. LATER Icon invest small amounts of money from purchases using an Acorns investment account. Our finance app offers real-time data on major indices like the Dow Jones and provides a stock tracker for keeping track of penny stocks. Both stock trading apps and market makers get a small amount through the PFOF model, but if they execute many orders, they get a significant amount and generate. Ally's stock app offers an easy-to-use trading platform and commission-free ETFs. Fees: $0 stock and ETF trades. Account Minimum: $0. Why you want this app: E*Trade is one of the best stock apps. It gives you plenty of choices to invest in, market analysis tools, and automated investing. Interactive Brokers is the best online broker for day trading, with a wide range of assets, excellent trading technology, and low margin rates. The 5 Best Stock Trading Apps · 1. Interactive Brokers: Best overall trading app · 2. Stash: Best trading app for micro-investing · 3. Schwab: Best for customized. Charles Schwab is an established name in the stock market and investing world. The Charles Schwab app allows you to take your trading account. E*TRADE: Invest. Trade. Save. 4+. Stocks, options, mutual funds. E*TRADE Securities. Designed for iPad. Save, invest and learn from one easy app. INVEST Icon. INVEST. LATER Icon invest small amounts of money from purchases using an Acorns investment account. Our finance app offers real-time data on major indices like the Dow Jones and provides a stock tracker for keeping track of penny stocks. Both stock trading apps and market makers get a small amount through the PFOF model, but if they execute many orders, they get a significant amount and generate. Ally's stock app offers an easy-to-use trading platform and commission-free ETFs. Fees: $0 stock and ETF trades. Account Minimum: $0. Why you want this app: E*Trade is one of the best stock apps. It gives you plenty of choices to invest in, market analysis tools, and automated investing. Interactive Brokers is the best online broker for day trading, with a wide range of assets, excellent trading technology, and low margin rates. The 5 Best Stock Trading Apps · 1. Interactive Brokers: Best overall trading app · 2. Stash: Best trading app for micro-investing · 3. Schwab: Best for customized. Charles Schwab is an established name in the stock market and investing world. The Charles Schwab app allows you to take your trading account.

Schwab Mobile is the trading app designed to help you monitor opportunities and place trades from wherever you are. It offers stocks, ETFs and themed portfolios, making it easy to start with as little as $5. With active and automated investing options, fractional shares and a. Buy thousands of stocks for as little as $1! · Invest a small amount. Choose the amount you would like to invest and buy a portion of a share. · Build your. You should start with a small amount in some simple app like Robinhood or Revolut. After you start understanding the basics, you can switch. Investr lets new users begin trading US stocks, exchange-traded funds and fractional shares with as little as $5, and without commission fees. Interactive Brokers is the best online broker for day trading, with a wide range of assets, excellent trading technology, and low margin rates. E*TRADE from Morgan Stanley charges $0 commission for online US-listed stock, ETF, mutual fund, and options trades. Exclusions may apply and E*TRADE from Morgan. From my experience, I would recommend Zerodha Kite. It's the most user friendly app for stock trading. It's just my personal opinion. I have. The Stash App is one of the trading apps specifically designed for investing. We like this app because it's easy for a newbie or experienced saver/investor who. Paytm Money is India's best overall trading application, offering Rs. free brokerage this month. Aside from that, the app has an easy-to-use interface. $ might not buy you a lot of stocks, but investing in one right stock may make you money. Using a discount broker, such as Ally, can help. In a nutshell. The best stock trading apps for beginners are eToro, XTB and Trading They're all low cost and have a huge range of investment options and. Olymp Trade is an international broker that provides its users access to + financial instruments on its platform. With this trading app, you will be able. Best for low fees: Robinhood Why we chose Robinhood: If you want to trade from your smartphone and avoid fees, Robinhood is one of the best investment apps. In summary, IBKR isn't a plug-and-play trading app like WeBull and Robinhood, but its impressive list of tradable assets, advanced research tools, and different. Newbies may want to start small by micro-investing through an app like Acorns, which invests users' spare change. Beginner and intermediate investors alike can. Degiro: Best for low brokerage fees for trading stock market assets. Interactive Brokers: Best overall. TradeStation: Best App for Active Traders. Tastyworks. Our Recommended Online Brokers · Our Top Picks for Best Forex Broker · poisk-progress.ru · Plus · eToro · FP Markets · XM Group · FxPro. A new generation, world-renowned social trading app, eToro is a one-stop destination for those who'd like to learn more about trading. eToro enriched its modern. No, there is no minimum investment amount required to trade on the Appreciate app. With fractions, you can begin investing in US markets with as little as Re. 1.

Forex Broker Credit Card Deposit

Debit & Credit Card Deposit via Mobile App · 1. Download the Trading Station app. Search for "FXCM Trading Station" in the app store. · 2. Log in with your. We accept debit cards backed by MasterCard, Visa and Discover. Debit card deposits are virtually instant. You'll need to verify your card before you can make a. You can deposit a minimum of $ per transaction if funding by bank transfer or debit card. However, we recommend a minimum $2, to allow you more. Global Prime Deposit Options ; Visa. Instant ; MasterCard. Instant ; Crypto. Instant ; PayPal. Instant. You can deposit a minimum of $ per transaction if funding by bank transfer or debit card. However, we recommend a minimum $2, to allow you more. Deposit as little as $, though we recommend starting with at least $2, to allow you more flexibility and better risk management when trading your account. Most Popular Credit/Debit Card Issuers Online forex brokers commonly accept deposits with popular card brands like Visa, Mastercard, Maestro, and American. LiteFinance offers the opportunity to deposit in your trading account by credit or debit card Visa/Mastercard directly via the processing center CardPay. To. You can easily fund your account via credit card, debit card, or wire transfer by logging in to MyAccount and visiting the Funding page. Debit & Credit Card Deposit via Mobile App · 1. Download the Trading Station app. Search for "FXCM Trading Station" in the app store. · 2. Log in with your. We accept debit cards backed by MasterCard, Visa and Discover. Debit card deposits are virtually instant. You'll need to verify your card before you can make a. You can deposit a minimum of $ per transaction if funding by bank transfer or debit card. However, we recommend a minimum $2, to allow you more. Global Prime Deposit Options ; Visa. Instant ; MasterCard. Instant ; Crypto. Instant ; PayPal. Instant. You can deposit a minimum of $ per transaction if funding by bank transfer or debit card. However, we recommend a minimum $2, to allow you more. Deposit as little as $, though we recommend starting with at least $2, to allow you more flexibility and better risk management when trading your account. Most Popular Credit/Debit Card Issuers Online forex brokers commonly accept deposits with popular card brands like Visa, Mastercard, Maestro, and American. LiteFinance offers the opportunity to deposit in your trading account by credit or debit card Visa/Mastercard directly via the processing center CardPay. To. You can easily fund your account via credit card, debit card, or wire transfer by logging in to MyAccount and visiting the Funding page.

Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Each forex broker has specific account withdrawal and funding policies. Brokers may allow account holders to fund accounts online via credit card, ACH payment. Credit card payments is another popular method to fund trading accounts that almost all CFD & forex brokers accept. Notably, AvaTrade accepts credit card transactions, providing traders with convenient deposit options for funding their accounts. With a diverse range of. To deposit with a credit card, you will have to find the payments page and select the credit card option from the list of supported service. From then on, the. To deposit with a credit card, you will have to find the payments page and select the credit card option from the list of supported service. From then on, the. Credit/Debit Card You can deposit a maximum of $10, (or currency equivalent) per transaction and funds will typically be available immediately for trading. You can deposit funds with a credit card, debit card, or bank transfer. For tastyfx is not a registered broker-dealer with the Securities and Exchange. Conditions for Deposits: ; Credit card deposit poisk-progress.ru poisk-progress.ru Free, Instantly ; Domestic payment in CZK and PLN; SEPA payment in EUR, Free, 1 business. Deposits through cards issued by Visa are carried out in an extremely straightforward fashion, which renders them a perfect fit for Forex traders. First off. Forex accounts can be funded by credit card, wire transfer, personal check, or bank check. In the past, currency trading was limited to certain individuals and. Forex brokers accepting deposit with credit and debit cards. Find the most reputable forex trading platforms that accept credit and debit card. After you log in to your Dominion Markets Account, you will need to deposit a minimum of $50 and create a free cTrader Trading Account to start trading. What. Please note, when you deposit with a credit card: We only accept payments made with cards issued in the name of the account holder. Credit & debit card forex brokers are FX brokers that offer the credit/debit card payment channel to deposit and withdraw funds from a forex trading account. While each website has its own peculiarities, all follow a similar model. To deposit with a credit card, you will have to find the payments page and select the. Issues Surrounding the Deposit Methods Used by Forex Brokers · Bank wire. The forex trader visits the payment page of the forex broker. · Credit/debit card. Does poisk-progress.ru accept Credit Cards, PayPal or Western Union? Does poisk-progress.ru accept debit cards? In which currencies can I deposit? Here when you need us. Brokers in general do not accept deposits by credit card. You will need to use a debit card whoever you go with. It's generally considered a very risky idea. Top 5 Best Forex Brokers accepting Credit Card · HFM – Best Overall Broker · BlackBull Markets – Best MT4 Broker · FP Markets – Lowest Spread Broker

Credit Cards That Have Money On It

Every Capital One cash back credit card gives you a percentage back for all qualifying purchases—so you can get rewarded for every dollar you spend. Cash back. Or you can check your balance by visiting the card issuer's site and entering your card's digit number and security code. Here's a selection of Visa Gift. 15 Best cash back credit cards for September · + Show Summary · Wells Fargo Active Cash® Card · Blue Cash Everyday® Card from American Express. Earn a $ bonus · Earn unlimited % cash back or more on all purchases · No Annual Fee. Find the best Chase no annual fee credit cards with cash back, rewards, and sign up bonuses. Compare our different card benefits and apply today for a no. If you decide to open multiple credit cards, it's a good idea to consider how each card can help you save money on your spending. You can maximize benefits by. Apply today for a U.S. Bank credit card. Browse & compare cash back credit cards, low intro APR credit cards & rewards credit cards designed for your. Such cards include the American Express Centurion (Black Card) and the JP Morgan Chase Reserve. Do the Rich Have Credit Cards? Yes, the rich. Earn cash back, travel rewards or consolidate debt with a lower interest rate, all with a Truist credit card. Easily apply for a new credit card online. Every Capital One cash back credit card gives you a percentage back for all qualifying purchases—so you can get rewarded for every dollar you spend. Cash back. Or you can check your balance by visiting the card issuer's site and entering your card's digit number and security code. Here's a selection of Visa Gift. 15 Best cash back credit cards for September · + Show Summary · Wells Fargo Active Cash® Card · Blue Cash Everyday® Card from American Express. Earn a $ bonus · Earn unlimited % cash back or more on all purchases · No Annual Fee. Find the best Chase no annual fee credit cards with cash back, rewards, and sign up bonuses. Compare our different card benefits and apply today for a no. If you decide to open multiple credit cards, it's a good idea to consider how each card can help you save money on your spending. You can maximize benefits by. Apply today for a U.S. Bank credit card. Browse & compare cash back credit cards, low intro APR credit cards & rewards credit cards designed for your. Such cards include the American Express Centurion (Black Card) and the JP Morgan Chase Reserve. Do the Rich Have Credit Cards? Yes, the rich. Earn cash back, travel rewards or consolidate debt with a lower interest rate, all with a Truist credit card. Easily apply for a new credit card online.

Earn up to 5% cash back on two categories you choose. U.S. BANK ALTITUDE ® GO. Earn 20, bonus points worth $ U.S. BANK VISA ® PLATINUM. Get a low. Explore a variety of credit cards including cash back, lower interest rate, travel rewards, cards to build your credit and more. Find the credit card that's. With the Truist Enjoy Cash card, you can earn unlimited cash rewards and choose how to earn cash back. Apply online today! Earn % cash back on everything you buy. Yes, everything. And pay no annual or foreign transaction fees**. Plus, if you have a Citizens Quest® Checking. With the PNC Cash Rewards Visa Credit Card, you can earn cash back on gas, groceries and the places you shop the most. Apply online today! Use your new Simply Rewards, Travel Select or Direct Cash credit card to make $1, in net purchases within 90 days of account opening and receive 15, bonus. You do not owe a bill since you are using money you already have. You do not need a bank account to use a prepaid card. You do not need a good credit history to. Capital One Platinum Secured Credit Card · Destiny Mastercard® – $ Credit Limit · Fortiva® Mastercard® Credit Card · PREMIER Bankcard® Mastercard® Credit Card. Earn cash back, travel rewards or consolidate debt with a lower interest rate, all with a Truist credit card. Easily apply for a new credit card online. Credit cards offer a fast, convenient way to pay in person or online. A transaction occurs when your credit card issuer and the merchant's bank exchange. Featured Partner Offers · 2% Cash Back Credit Cards · 5% Cash Back Credit Cards · Cash Back Business Credit Cards · How To Get Cash Back On A Credit Card · Miles Vs. Explore our line of credit and digital credit card options. Discover our debit card, get cash back with the PayPal credit card, and finance purchases. It's called churning. But it's not free money with absolutely no catch for simply signing up for a card. The sole notable exception to this is. If you decide to open multiple credit cards, it's a good idea to consider how each card can help you save money on your spending. You can maximize benefits by. Earn a $ bonus · Earn unlimited % cash back or more on all purchases · No Annual Fee. There are several ways to get cash back from your credit card. You can withdraw money at an ATM or receive convenience checks from your card issuer that, when. Explore our line of credit and digital credit card options. Discover our debit card, get cash back with the PayPal credit card, and finance purchases. There are two Citi credit cards that offer instant credit card numbers: the Citi Double Cash Card and the Citi Custom Cash Card. Other cards may also be. Discover credit cards include rewards like cash back or miles so you can pick the best rewards credit card for you. All with no annual fee. Apply with more. Key Takeaways · Credit cards are plastic or metal cards used to pay for items or services using credit. · Credit cards charge interest on the money spent. · Credit.

The Fastest Way To Build Credit

Make All Payments On Time · Keep Credit Utilization Low · Strive For A Long Credit History · Keep A Diverse Mix Of Credit · Spread Out Credit. My credit score is constantly increasing, 85 points so far. I love the borrow option. Brandon Thompson. MY CREDIT SCORE IS There are several ways you can improve your credit score, including making on-time payments, paying down balances, avoiding unnecessary debt and more. 6 Ways to Build Credit Before Buying a Home · 1. Reality check · 2. Use your status as a renter to your advantage · 3. Be picky about credit cards · 4. Keep credit. To build good credit, always pay your household and credit card bills on time since late payments will lower your credit score. If you have trouble remembering. How do you build or establish credit? · Secured credit cards. Secured credit cards are designed to help the user build credit history, making them a perfect. Credit cards are the easiest ticket to establishing credit and improving your score. You can use them at nearly every store and online site, pay for public. Ways to build credit · 1. Understand credit-scoring factors · 2. Develop and maintain good credit habits · 3. Apply for a credit card · 4. Try a secured credit card. Find a co-signer. Another helpful way to build credit is by having a co-signer for certain loans, with the co-signer being responsible for the full loan amount. Make All Payments On Time · Keep Credit Utilization Low · Strive For A Long Credit History · Keep A Diverse Mix Of Credit · Spread Out Credit. My credit score is constantly increasing, 85 points so far. I love the borrow option. Brandon Thompson. MY CREDIT SCORE IS There are several ways you can improve your credit score, including making on-time payments, paying down balances, avoiding unnecessary debt and more. 6 Ways to Build Credit Before Buying a Home · 1. Reality check · 2. Use your status as a renter to your advantage · 3. Be picky about credit cards · 4. Keep credit. To build good credit, always pay your household and credit card bills on time since late payments will lower your credit score. If you have trouble remembering. How do you build or establish credit? · Secured credit cards. Secured credit cards are designed to help the user build credit history, making them a perfect. Credit cards are the easiest ticket to establishing credit and improving your score. You can use them at nearly every store and online site, pay for public. Ways to build credit · 1. Understand credit-scoring factors · 2. Develop and maintain good credit habits · 3. Apply for a credit card · 4. Try a secured credit card. Find a co-signer. Another helpful way to build credit is by having a co-signer for certain loans, with the co-signer being responsible for the full loan amount.

The single most important way to improve your credit score is by paying your credit cards, installment loans, and any other credit line on time. Pay off debt rather than moving it around: the most effective way to improve your credit scores in this area is by paying down your revolving (credit card) debt. If you're ready to build your credit, Kikoff is the fastest, smartest, and easiest way to do it. Kikoff customers who make on-time payments see improvements. If you have a limited history of using credit or have no experience with credit at all, these actions can help you build your credit history. 1. Pay off or consolidate debt · 2. Get a secured credit card · 3. Ask for a credit limit increase · 4. Become an authorized user · 5. Get a secured loan · 6. Get a. Lower your credit utilization rate. The fastest way to get a credit score boost is to lower the amount of revolving debt (which is generally credit cards) you'. How to Build Good Credit · Review your credit reports. · Get a handle on bill payments. · Use 30% or less of your available credit. · Limit requests for new credit. 4 key credit moves for somethings · Pay your bills on time and in full · Consider tools to help establish credit · Don't use all your credit · Check your credit. 6 ways to build credit without using a credit card · 1. Credit-builder loan. A credit-builder loan essentially allows you to lend yourself money, Kelly explains. The time it takes to build good credit can be different for everyone. But it generally takes about three to six months to get your first credit score. Rapid rescoring typically takes three to five business days to complete and is generally most helpful when someone is actively evaluating your credit scores. The best way to reduce the interest owed on a credit card is to pay off the balance as quickly as possible. Otherwise, it may take many years to pay off. Personal finance experts recommend keeping your credit utilization ratio under 30%, but it's best to get it as low as possible. Action item: Reduce your. How to keep building your credit for a great credit score · Short-term credit-building strategies · Check your credit report for errors · Always pay your bills on. Credit-builder loans and secured personal loans can be used to help you establish your credit score by building a positive payment history. The fastest way to build credit in Canada, it depends on how you define “fast.” The truth is, there's no way to instantly improve your credit score. The best practice is to pay your credit card bills in full every month. If you can't, pay as much as possible. Try to keep your credit utilization rate below. Your first step is to get a secured credit card. Not all banks offer them, but most credit unions do. A deposit of $ should get you a secured card with a $. Building a good credit score · Review your credit report · Create a plan · Consider a debt consolidation loan or balance transfers to a lower rate credit card.

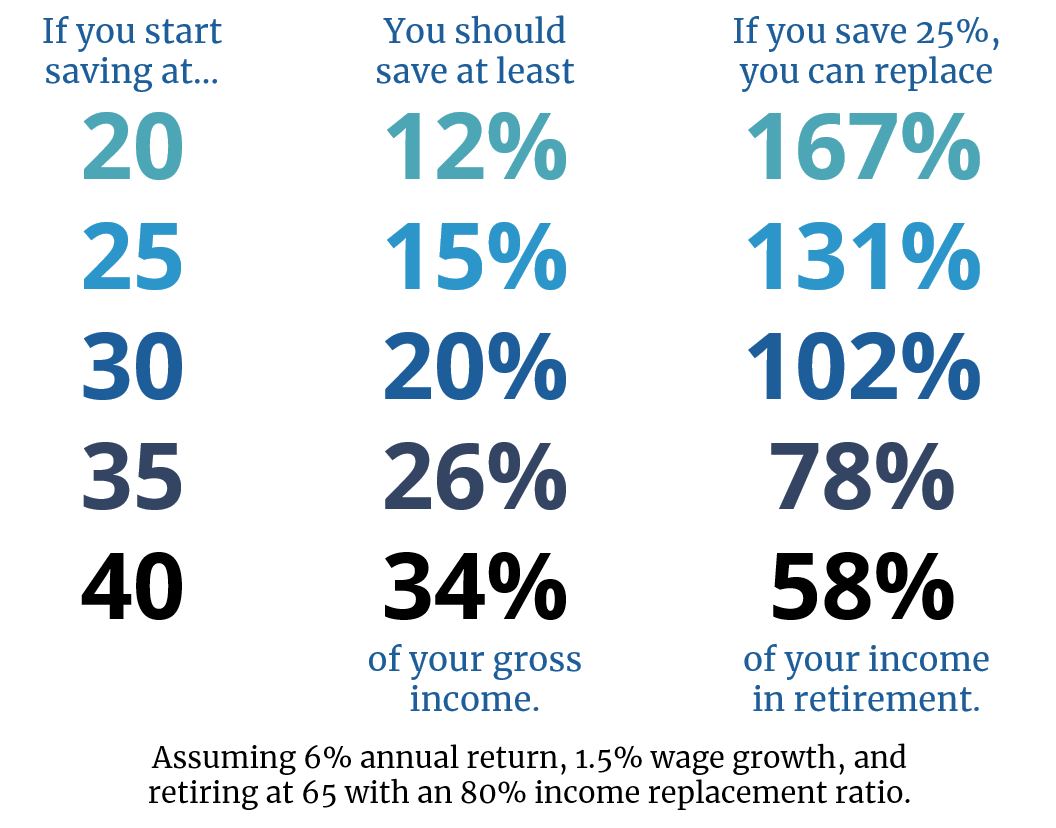

How Much Should Someone Save For Retirement

For example, if you are 29, making $,, you would want a savings of $35, - $90, to maintain your current lifestyle. (The higher and lower ends of the. How Much Money You Should Have in Savings · Aim to save 20% of your take-home pay each month. · For retirement savings, aim to save 10% to 15% of your pre-tax. Fidelity's guideline: Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by Factors that will impact your personal savings. It averages out to around 15–18% of net income, which should come out to a decent nest egg for retirement. So just save something, whether it's. Why it's important to save for retirement as soon as you can ; Start saving at age: 25, 35 ; Saving for: 10 years, 30 years ; Yearly contributions: $3,, $3, How much a person has set aside when they retire depends on their retirement age and their reason for retiring. Forty percent of baby boomers have at least. Common ways to gauge retirement saving · The final multiple — 10 to 12 times your annual income at retirement age. · The pacing angle — a multiple of your annual. For instance, if you don't start saving until you are 30, Fidelity recommends you put aside 18% of your salary a year. Someone starting at age 35 should try for. Others recommend saving up to times your salary by age 35, to six times your salary by age 50, and six to 11 times your salary by age Average. For example, if you are 29, making $,, you would want a savings of $35, - $90, to maintain your current lifestyle. (The higher and lower ends of the. How Much Money You Should Have in Savings · Aim to save 20% of your take-home pay each month. · For retirement savings, aim to save 10% to 15% of your pre-tax. Fidelity's guideline: Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by Factors that will impact your personal savings. It averages out to around 15–18% of net income, which should come out to a decent nest egg for retirement. So just save something, whether it's. Why it's important to save for retirement as soon as you can ; Start saving at age: 25, 35 ; Saving for: 10 years, 30 years ; Yearly contributions: $3,, $3, How much a person has set aside when they retire depends on their retirement age and their reason for retiring. Forty percent of baby boomers have at least. Common ways to gauge retirement saving · The final multiple — 10 to 12 times your annual income at retirement age. · The pacing angle — a multiple of your annual. For instance, if you don't start saving until you are 30, Fidelity recommends you put aside 18% of your salary a year. Someone starting at age 35 should try for. Others recommend saving up to times your salary by age 35, to six times your salary by age 50, and six to 11 times your salary by age Average.

When considering average savings by age 30, data shows you should have at least $14, to $28, in savings and $61, in retirement savings If your. The first step is to get an estimate of how much you will need to retire securely. One rule of thumb is that you'll need 70% of your annual pre-retirement. Why You Should Open a Personal Retirement Savings Account Now. Financial experts say you'll need 70 to 80 percent of your pre-retirement income to maintain your. A person in their 20s would likely reach their retirement goals by saving 10% to. Find additional ways to save. Here are some options. Many experts maintain that retirement income should be about 80% of a couple's final pre-retirement annual earnings. Most retirement professionals would say that by the time someone has reached this age group, they should be well on their way toward achieving their savings. General Rule of Thumb for Retirement Savings: 80%. The consensus is that by the time you retire, you should have saved at least 80% of your salary for each year. You probably have a lot of questions about saving for retirement. How much will I need? What year will I retire? What are the best ways to save for. If the company kicks in 5%, then you save at least 5%. If your employer does nothing, set aside at least 10% of each paycheck on your own. (If you are older and. The rule of thumb is to religiously save and invest 15% of your gross income if you want to retire at around If you want to retire sooner. How much should I save for retirement? · 1. Aim to save between 10% and 15% of your annual pretax income for retirement · 2. Determine how much retirement income. Having a dollar amount as your long-term savings goal is good, but it's also helpful to focus on how much you should sock away each year. Traditionally, 10% to. You should have $ million saved for retirement. Why 20 times your annual expenses? Because, over time, the money in your retirement fund. The long-held rule of thumb was that you should put away 10 percent of your annual income for retirement. To have sufficient savings for a lifestyle in retirement that covers your annual retirement expenses of $49,, we recommend saving a minimum of $ a month. The average household income in America is about $74, Let's say you invested 15% of that from age 30 to age 70 in good growth stock mutual funds. Do you. Keep in mind that your 20% savings goal includes the money you're saving for retirement. If your employer is automatically depositing money into your (k). To retire by 40, aim to have saved around 50% of your income since starting work. And retirement at 65 is still a mind-boggling 44 years away! Either way, you haven't hit your peak earning years, so you're not earning a lot. However, a good.

Covalent Software

Covalent Software is a supplier of Performance and corporate management software to the UK public sector. Established in , Covalent Software specializes. Pythonic tool for orchestrating machine-learning/high performance/quantum-computing workflows in heterogeneous compute environments. - AgnostiqHQ/covalent. Covalent Solutions is a Technology Services company dedicated to long-term customer relationships and their success. Learn how Covalent can help your business. GetApp provides users in South Africa with the most detailed information on software tools, prices and features. Covalent is a performance management software that provides complete, real time visibility and control of strategic and operational performance and risk in. About C2 Covalent. C2 Covalent is a cloud-based loan origination solution designed to help banks, credit unions and financial institutions automate the. Covalent's is an enterprise-grade software platform designed for manufacturers to build and deploy job-specific qualification processes on-the-floor and. Covalent Software develops performance management software solutions for the UK-based public sector. Covalent is a modular data infrastructure and decentralized network run by node operators in 25 countries. Covalent Software is a supplier of Performance and corporate management software to the UK public sector. Established in , Covalent Software specializes. Pythonic tool for orchestrating machine-learning/high performance/quantum-computing workflows in heterogeneous compute environments. - AgnostiqHQ/covalent. Covalent Solutions is a Technology Services company dedicated to long-term customer relationships and their success. Learn how Covalent can help your business. GetApp provides users in South Africa with the most detailed information on software tools, prices and features. Covalent is a performance management software that provides complete, real time visibility and control of strategic and operational performance and risk in. About C2 Covalent. C2 Covalent is a cloud-based loan origination solution designed to help banks, credit unions and financial institutions automate the. Covalent's is an enterprise-grade software platform designed for manufacturers to build and deploy job-specific qualification processes on-the-floor and. Covalent Software develops performance management software solutions for the UK-based public sector. Covalent is a modular data infrastructure and decentralized network run by node operators in 25 countries.

Information on valuation, funding, cap tables, investors, and executives for Covalent (Software Development Applications). Use the PitchBook Platform to. Covalent Technologies believes in a free and open Internet. The company provides software that is used to manage open-source Tomcat and Apache Web server. software products, related efforts, events, technical reports, etc. and engage in community-wide efforts to tackle workflows grand challenges. ©— See what employees say it's like to work at Covalent Softwares. Salaries, reviews, and more - all posted by employees working at Covalent Softwares. Transform your online presence with Covalent Softwares, the Best Website Designing Company. Innovative designs customized for your success. Get more information for Covalent Software in Clearwater, FL. See reviews, map, get the address, and find directions. Covalent is a Pythonic workflow tool for computational scientists, AI/ML software engineers, and anyone who needs to run experiments on limited or expensive. Covalent serves as a bridge between an organization's ERP system and other software applications, ensuring seamless data integration and communicat. Covalent Performance and Risk Management software integrates all of your management data in to an integrated solution to improve performance and reduce. Covalent Softwares Pvt. Ltd. is best known as a total IT solutions provider for our clients, focusing on Web Solutions, Enterprise Messaging, IT Consultancy. Company profile page for Covalent Software Ltd including stock price, company news, executives, board members, and contact information. C2 Covalent is C2's flagship loan origination software solution that integrates Consumer and Small Business credit decisioning and origination on a single. Formed in , Covalent Software Limited has grown into the UK's leading cloud-based Corporate Performance Management (CPM) and Governance, Risk & Compliance. Covalent Softwares Pvt. Ltd., The Ultimate Bonding. likes · 1 talking about this. Covalent Softwares is a leading global Website, Web development &. Helping businesses bring ideas to life with custom software development solutions and professional services. Who owns Covalent Software? Covalent Software is owned by Ideagen. It was acquired on August 8, Covalent Software, performance management and risk management software. Here you'll find information about their funding, investors and team. COVALENT SOFTWARE LIMITED - Free company information from Companies House including registered office address, filing history, accounts, annual return. Covalent Software has signed a number of new customers for its performance management system, including Colchester Borough Homes, Colchester Borough Homes, East.

How To Make Money Teaching Online Courses

We are here to tell you that you don't need any expensive software and tech to start tutoring online and make money. Online English Teaching is pleased to announce another course that is available through our partnership with International Open Academy, called Make Money. There can be two options for you. Either you can create content for free and earn from ads or you can earn per hour by teaching students online. Common ones are VIPKid (for English), Preply (many subjects), and Chegg (school help). 2. Course Creation Platforms. These hubs let you design and sell your. Plan Your Lessons: Prepare structured lesson plans that suit the level and interests of your students. Being prepared shows professionalism and can lead to more. Set Up Your Account: Create an account on teaching platform. 3. Plan Your Syllabus: Outline what you'll teach and how. 4. Promote Your Courses: Market your. We will share how to teach online classes and make money online; we will show you the tools you need to start creating online courses or teach live classes. Best website to start teaching online and making money instantly? I have recently completed a hr TEFL course and have a university. Teaching online can be a fun and profitable business. You can start part-time to generate some extra income and grow it to become a full-time business if you. We are here to tell you that you don't need any expensive software and tech to start tutoring online and make money. Online English Teaching is pleased to announce another course that is available through our partnership with International Open Academy, called Make Money. There can be two options for you. Either you can create content for free and earn from ads or you can earn per hour by teaching students online. Common ones are VIPKid (for English), Preply (many subjects), and Chegg (school help). 2. Course Creation Platforms. These hubs let you design and sell your. Plan Your Lessons: Prepare structured lesson plans that suit the level and interests of your students. Being prepared shows professionalism and can lead to more. Set Up Your Account: Create an account on teaching platform. 3. Plan Your Syllabus: Outline what you'll teach and how. 4. Promote Your Courses: Market your. We will share how to teach online classes and make money online; we will show you the tools you need to start creating online courses or teach live classes. Best website to start teaching online and making money instantly? I have recently completed a hr TEFL course and have a university. Teaching online can be a fun and profitable business. You can start part-time to generate some extra income and grow it to become a full-time business if you.

Another perk of online courses is that you can earn passive income, freeing you up to grow your business in other ways. With courses, you can charge a premium—. Teach specialist English lessons. Specialist classes, such as a business English or exam preparation classes, usually pay considerably more than general or. 5 Simple Steps To Make Money Selling Online Courses · Step 1: Discover what people in your niche are looking for · Step 2: Write an enticing. Recording videos in advance is a great technique to use for teaching an online course. But it's also easy for students to zone out with this kind of content, so. 1. Udemy. Udemy is a leading online learning marketplace that empowers you to create and sell your courses. · 2. Coursera · 3. edX 🏛️ · 4. How Can I Monetize Online Courses? The best way to make money selling courses is to set up an LMS website using any LMS platform that supports payment. You can sell your curriculums, lesson plans, and other educational materials on TeachersPayTeachers. This online marketplace lets you share your best work and. 3 Different Ways to Teach Online · #1: Sell Online Courses (Build Your Own Online Course Business) · #2: Sell Online Courses Through a Marketplace · #3: Become an. Offering students the option to block book lessons is a great way of filling up your schedule with guaranteed income as these are paid for in advance. An. We are here to tell you that you don't need any expensive software and tech to start tutoring online and make money. As mentioned earlier, you can use ad revenue splitting to earn money every time someone watches an ad before your video classes, or affiliate programs, which. Teaching classes, tutoring, grading standardized tests—they're all ways teachers or people with teaching experience can make money online. Online Classes on Outschool · Private Tutoring Online · Teach English Online with VIP Kid · Teach a Foreign Language with Rosetta Stone · K12 Online Teacher. You can explore your niche of expertise: Online teaching websites pay a tutor to put up online courses on their platforms. When looking for how to teach online. The way to become an online educator at Udemy is simple. You need to design and develop a course and then promote it to earn money. But it's not as simple as it. Or, if you want to teach online courses using videos, Amazon Prime or Vimeo on demand allows students to stream online classes on demand! Some platforms will. online courses. I was dubbed the “The Six-Figure Teacher” in articles such as Learn How to Earn an Income Teaching Online. Resources. FREE Mini Course. Online Teachers/tutors can earn Handsome amount by Selling Courses online. Learn How instructors Earn More Money by Teaching Students Online on Internet. Create, host and sell courses in 5 simple steps on one of the leading learning marketplaces to increase your influence and income. Leverage our teaching. With online companies typically offering $13 – $25 per hour (not per lesson), there's no reason you can't earn money if you're able to teach plenty of lessons.

Ishare Russell

Get the latest iShares Russell ETF (IWM) real-time quote, historical performance, charts, and other financial information to help you make more. The iShares Russell ETF seeks to track the investment results of a broad-based index composed of U.S. equities. The iShares Russell ETF seeks to track the investment results of an index composed of large- and mid-capitalization U.S. equities. Find here information about the iShares Russell Growth ETF, assess the current IWF stock price. You can find more details by going to one of the sections. A high-level overview of iShares Russell ETF (IWM) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. iShares Russell Value ETF (IWD) share price today is $ Can Indians buy iShares Russell Value ETF shares? Invests in a portfolio of assets whose performance seeks to match the performance of the Russell ® Index. IWF | A complete iShares Russell Growth ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. Find the latest iShares Russell ETF (IWB) stock quote, history, news and other vital information to help you with your stock trading and investing. Get the latest iShares Russell ETF (IWM) real-time quote, historical performance, charts, and other financial information to help you make more. The iShares Russell ETF seeks to track the investment results of a broad-based index composed of U.S. equities. The iShares Russell ETF seeks to track the investment results of an index composed of large- and mid-capitalization U.S. equities. Find here information about the iShares Russell Growth ETF, assess the current IWF stock price. You can find more details by going to one of the sections. A high-level overview of iShares Russell ETF (IWM) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. iShares Russell Value ETF (IWD) share price today is $ Can Indians buy iShares Russell Value ETF shares? Invests in a portfolio of assets whose performance seeks to match the performance of the Russell ® Index. IWF | A complete iShares Russell Growth ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. Find the latest iShares Russell ETF (IWB) stock quote, history, news and other vital information to help you with your stock trading and investing.

iShares Russell ETF IWM has $ BILLION invested in fossil fuels, % of the fund. The Russell Index is an unmanaged market capitalization-weighted index measuring the performance of the 1, largest companies in the Russell Index. iShares Trust - iShares Russell Top Value ETF is an exchange traded fund launched by BlackRock, Inc. The fund is managed by BlackRock Fund Advisors. The fund tracks the popular Russell index. IWM's broad basket makes it one of the most diversified funds in the segment. Notably, the fund delves into. The Fund seeks to track the investment results of the Russell Index which measures the performance of the small-capitalization sector of the US equity. The latest fund information for iShares Russell ETF, including fund prices, fund performance, ratings, analysis, asset allocation, ratios & fund. View the latest iShares Russell ETF (IWM) stock price and news, and other vital information for better exchange traded fund investing. Learn everything you need to know about iShares Russell Growth ETF (IWF) and how it ranks compared to other funds. Research performance, expense ratio. The iShares Russell ETF seeks investment results that correspond generally to the price and yield performance of the Russell Index. Price. Get the latest iShares Russell Value ETF (IWN) real-time quote, historical performance, charts, and other financial information to help you make more. iShares Russell ETF IWM · NAV. · Open Price. · Bid / Ask / Spread. / / % · Volume / Avg. Mil / Mil · Day Range. The ETF tracks the performance of the Russell Index. The ETF holds mid and small-cap U.S. stocks. Its investments are in the smallest companies from. Latest iShares Russell ETF (IWM:PCQ:USD) share price with interactive charts, historical prices, comparative analysis, forecasts, business profile and. iShares Russell Growth ETF IWF has $ BILLION invested in fossil fuels, % of the fund. Complete iShares Russell Growth ETF funds overview by Barron's. View the IWO funds market news. Get iShares Russell ETF (IWB:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. iShares Russell Growth ETF (IWO) to its benchmarks. Cumulative Returns %. Annualized Returns %. iShares Russell Growth ETF. Market. + + +. The investment seeks to track the investment results of the Russell ® Growth Index, which measures the performance of large- and mid-capitalization growth. What Is the iShares Russell Ticker Symbol? IWM is the ticker symbol of the iShares Russell ETF. What Is the IWM Stock Price Today? The IWM stock price. iShares Russell Growth ETF · 1. Amphenol Corp Class A. $M. % · 2. GE Aerospace. Nuclear weapons. $M. % · 3. Lockheed Martin Corp. Nuclear.

Forex 24 7

The forex market is open 24 hours a day during the weekdays which allows traders to potentially trade all day and all night. Forex hours of trading, conveniently, in any timezone © Helloka, LLC • [email protected] • About • Feedback. Looking to trade anytime? The forex market is the place for you, trading is open continuously 24 hours per day, five days a week. The continuous liquidity of the Forex market is based on the fact that the markets are opened for 24 hours a day in any part of the world. From the New. hours whether you're trading Forex, Commodities, Indices, or Cryptocurrency. For instance, the Cryptocurrency market is open 24 hours a day, 7 days a week. Forex Market Hours. Forex Market Hours. Before looking at the best times to trade, we must look at what a hour day in the forex world looks like. The forex. The global Forex markets are open and trading 24 hours a day, from Monday to Friday. The FX market does take a break over the weekend however, so you could say. Forex Trading on CFD at Skilling. Access the world's largest market and Trading. Account types · All Instruments · Trading hours · Commissions and swap. The concept of 24/7 Forex trading means that the market is open 24 hours a day, seven days a week, without any weekend breaks or closures. The forex market is open 24 hours a day during the weekdays which allows traders to potentially trade all day and all night. Forex hours of trading, conveniently, in any timezone © Helloka, LLC • [email protected] • About • Feedback. Looking to trade anytime? The forex market is the place for you, trading is open continuously 24 hours per day, five days a week. The continuous liquidity of the Forex market is based on the fact that the markets are opened for 24 hours a day in any part of the world. From the New. hours whether you're trading Forex, Commodities, Indices, or Cryptocurrency. For instance, the Cryptocurrency market is open 24 hours a day, 7 days a week. Forex Market Hours. Forex Market Hours. Before looking at the best times to trade, we must look at what a hour day in the forex world looks like. The forex. The global Forex markets are open and trading 24 hours a day, from Monday to Friday. The FX market does take a break over the weekend however, so you could say. Forex Trading on CFD at Skilling. Access the world's largest market and Trading. Account types · All Instruments · Trading hours · Commissions and swap. The concept of 24/7 Forex trading means that the market is open 24 hours a day, seven days a week, without any weekend breaks or closures.

The foreign exchange (forex) market is one of the most dynamic and liquid financial markets in the world, operating around the clock and. Forex specialists available 24/5; Specialized tools on thinkorswim®. Forex Chat. Professional answers 24/7. The paperMoney® software application is. Forex market (Foreign Exchange Market or Currency Exchange Market) is open 24 hours a day. It provides a great opportunity for traders to trade at any. The majority of FX pair trading hours are 24 hours per day during the week, with a two minute break from server time until server time. 24 hours Forex Clock with market activity and strategic points. Forex Fully visual. Market 24h Clock. set timezone: UTC UTC · UTC · UTC · UTC You can trade most FX pairs, hours during the week because Forex never sleeps. There is a two-minute break from server time until server time. When you first came to know about the global currency market, you probably came in touch with marketing materials claiming that this market remains open Yes, the markets are open 24 hours outside of weekends normally, because international sessions overlap. There will be likely a large move as. The forex trading hours are 24 hours a day, 5 days a week across the world. See the forex market hours for the best trading sessions in your time zone. The forex market's capacity to trade 24 hours a day is due to a combination of several worldwide time zones and the fact that deals are made through a network. The forex market is open 24 hours a day, from Sunday evening until Friday night. This is due to the various international time zones which allow you to trade. With City Index, you can trade forex hours a day from 10pm (UTC) on a Sunday evening to 10pm (UTC) on a Friday night. Why trade forex? But being open 24 hours isn't the only benefit of trading forex. There are two other key reasons why it's the world's most popular market. Forex market hours are the times when forex traders from all over the world can buy, sell, swap, and speculate on global currencies. During the week, the FX. Why do people trade forex? Taking a position on currencies strengthening or weakening; Hedging with forex; Seize opportunity 24 hours a day. What are the major Forex market trading hours? Easily convert the major market trading hours into your own time zone. You can trade 24/5 from Sunday am till Friday am (GMT + 2). The market is divided into four major trading sessions: The Sydney session, the Tokyo. Trading the hour forex market. There are three major forex trading sessions which make up the hour market: the European session, the US session and the. Forex Market Sessions. Because this is a 24 hour market, there is always at least one active trading session. There are even times when these sessions overlap. The Forex market is open 24 hours a day. This means that traders can trade Forex 24 hours a day, without a break.

If You Make Minimum Payment On Credit Card

The most common credit card minimum payment is $15 or $25 but the minimum payment will increase as the total credit card balance increases. Can I pay more than. Although always making at least the minimum payments will help you avoid late fees and charges, it doesn't mean you won't pay interest. How much interest you. A credit card minimum payment is the smallest amount due each monthly billing cycle. Paying the minimum on time can help you avoid penalties and fees. Make the minimum payment on all your cards to avoid late fees and finance charges. Pay extra on your credit card with the highest interest rate. Once that card. The minimum amount due for your credit card is a nominal figure that you have to pay every month to keep using your card and save yourself from any negative. Choose Your Debt Amount · Contact Your Creditor Immediately · What Happens If You Skip the Payment · Know Your Payment Policies · Prioritize Your Bills & Budget. As long as you pay your minimum you'll be okay. Interest will accumulate tho. And if you're utilization is high, your credit score will probably. If you make at least your credit card's minimum payment by the due date, you will avoid late fees and penalty APRs. However, any unpaid balance carried between. What happens when you only pay the minimum on your credit card bill? · You'll accrue interest charges: If you pay only the minimum, this will likely result in. The most common credit card minimum payment is $15 or $25 but the minimum payment will increase as the total credit card balance increases. Can I pay more than. Although always making at least the minimum payments will help you avoid late fees and charges, it doesn't mean you won't pay interest. How much interest you. A credit card minimum payment is the smallest amount due each monthly billing cycle. Paying the minimum on time can help you avoid penalties and fees. Make the minimum payment on all your cards to avoid late fees and finance charges. Pay extra on your credit card with the highest interest rate. Once that card. The minimum amount due for your credit card is a nominal figure that you have to pay every month to keep using your card and save yourself from any negative. Choose Your Debt Amount · Contact Your Creditor Immediately · What Happens If You Skip the Payment · Know Your Payment Policies · Prioritize Your Bills & Budget. As long as you pay your minimum you'll be okay. Interest will accumulate tho. And if you're utilization is high, your credit score will probably. If you make at least your credit card's minimum payment by the due date, you will avoid late fees and penalty APRs. However, any unpaid balance carried between. What happens when you only pay the minimum on your credit card bill? · You'll accrue interest charges: If you pay only the minimum, this will likely result in.

Not only does paying the minimum payment on your credit card increase the amount you pay in interest, but it can also impact your credit score. One of the. The minimum payment usually does little more than pay the interest, gaining almost nothing on the principle. That's why credit card companies. If you pay less than the minimum amount you will be counted as behind with payments and may be charged default or late payment charges. Interest will be added. However not paying the minimum dues demanded will affect your Credit score and probably the limit in future. Paying the minimum is the path to. For credit cards, this is calculated as your minimum payment. Your monthly payment is calculated as the percent of your current outstanding balance you entered. For credit cards, this is calculated as your minimum payment. Your monthly payment is calculated as the percent of your current outstanding balance you entered. The best way to use a credit card is to pay the balance in full every month. If you can do that you are no longer paying interest on things you purchased a. If you cannot afford the increase, you should contact your bank right away to discuss your specific situation and explore options that may be available to. Late Payment Warning: If we do not receive your minimum payment by the date listed above, you may have to pay a $35 late fee and your APRs may be increased up. Before sharing sensitive information, make sure you're on a federal government site. This video shows what happens when someone makes just the minimum payment. The interest you will pay in this example if you only made your minimum payments? $1,, over the next months. What if you made $50 payments each month? Minimum Payment Warning: If you make only the minimum payment each period, you will pay more in interest and it will take you longer to pay off your balance. Paying the minimum is definitely worth doing if the alternative is not making any payment. It stops your credit card issuer from reporting you for late payment. Paying more than the minimum will reduce the interest you owe on your credit card balance. If you pay your balance in full every month, you can avoid interest. If you make at least your credit card's minimum payment by the due date, you will avoid late fees and penalty APRs. However, any unpaid balance carried between. By carrying a balance and making minimum payments, you're essentially allowing interest to compound on the remaining amount. Over time, this can significantly. Anyways, if you put that couch on a credit card offering 0% APR for 18 months, you could make monthly payments averaging $5, / 18 = $ and fully pay off. Minimum Payment Warning: If you make only the minimum payment each period, you will pay more in interest and it will take you longer to pay off your balance. This calculator tells you how long it will take to pay off your credit cards—and how much interest you'll pay—if you only pay the minimum each month.

1 2 3 4 5 6 7 8 9